Matthias Schlegl in the Faculty of Economics, applies new macroeconomic models to study economic dynamics with zero interest rates. These innovative models facilitate economic analysis in zero interest rate environments, a task standard models struggle with. Japan has maintained a zero interest rate policy for over two decades, providing a critical backdrop for his research. His research encompasses Japan’s labor market dynamics, characterized by stagnant wages despite low unemployment, and the impact of credit booms and busts on aggregate demand. Looking ahead, he plans to expand his research into open economy contexts, supply-side spillovers, and inequality analysis.

My expertise lies in macroeconomics, financial markets, and international finance, focusing on the economic dynamics when interest rates are (close to) zero. As a student during the global financial crisis in the late 2000s, I observed Europe and the US implement zero interest rate policies while Japan had already maintained this policy for a decade. Japan’s experience offers valuable lessons on how the economy functions under prolonged zero interest rates, enabling Europe to better navigate similar economic conditions.

Interest rates serve as the price balancing savings and investment. Low interest rates indicate a high supply of savings and low demand for investment. In Japan, longer life expectancy and a less generous retirement system have led to high supply of savings while demographic changes have reduced investment opportunities. Japan’s zero interest rate policy is a negative outcome of these structural issues. Similar trends were seen in Europe, where demographic shifts and regulatory factors limit investment incentives. These structural issues challenge banking and social security systems, as lower interest rates reduce returns on savings while increasing the burden on pension systems due to longer life expectancies.

Labor Market and Credit Booms and Busts Under Zero Interest Rates

Economic models developed by Professor Yoshiyasu Ono at Osaka University have enabled economic analysis under zero interest rates, which standard macroeconomic models cannot do. These new models provide a richer framework for analyzing economic factors under zero interest rates, such as stagnation of prices, wages, and the economic growth experienced by Japan. We apply and calibrate these models to examine various aspects of the economy under zero interest rates.

I have applied these models to explain Japan’s labor market puzzle, where wages remain stagnant despite low unemployment. The findings show significant underemployment through irregular and temporary employment, while traditional unemployment remains low. This disparity explains the lack of upward pressure on wages despite low official unemployment, highlighting a fundamental shift in employment patterns that challenges traditional economic indicators.

Another analysis evaluates the effects of credit boom and busts. In the 1980’s, Japan experienced a bubble economy with soaring stock and land prices, leading households to borrow excessively. A similar scenario occurred in the US, where rising asset prices encouraged borrowing and further inflated asset values. When asset prices declined, borrowers had to reduce consumption to repay debts. Incorporating the phenomenon of rising stock and housing prices during a stagnant economy, our model shows that zero interest rates can lead to financial instability and bubble formation. Efforts to repay debt are counterproductive, suppressing consumption, and weakening overall economic demand. Consequently, even as individuals reduce their debt, declining incomes offset these gains, perpetuating high debt burdens. Unlike a typical recession which is followed by a natural recovery with some self-correction, the economy lacks such a recovery mechanism when interest rates are at zero, prolonging economic hardship.

Future Research Directions: Open Economy, Inequality, Supply-Side Impact, and Our Contribution to Society and Academia

I have several upcoming projects. One is extending our model to an open economy context, comparing countries with and without zero interest rates, examining exchange rates, product specialization, production offshoring, international trade, and labor mobility. Another project will address inequality by incorporating riskiness and liquidity into the model, and examining interest rate spreads to analyze portfolio allocation decisions. Additionally, we plan to explore various supply-side impacts such as household and corporate spending, investment in education, human capital, population growth, technology advancement, and innovation incentives.

Our contribution to academia is providing an alternative to pre-crisis macroeconomic models, which addresses their limitations in handling zero interest rate environments. Unlike traditional models that view wealth accumulation solely for future consumption, our model regards wealth as an end in itself. This perspective allows for a deeper analysis of inequality dynamics, underscoring differences in consumption behaviors between wealthy and poor households. An increased desire to save leads to higher saving and lower consumption, lowering interest rates – the price of saving. This mechanism helps explain the persistence of zero interest rates, a phenomenon standard models fail to explain. This approach equips economists with a robust tool to analyze contemporary economic issues, offering a comprehensive framework for understanding the complexities of modern financial environments. Lastly, these frameworks help in the analysis of policy options in countries with zero interest rates.

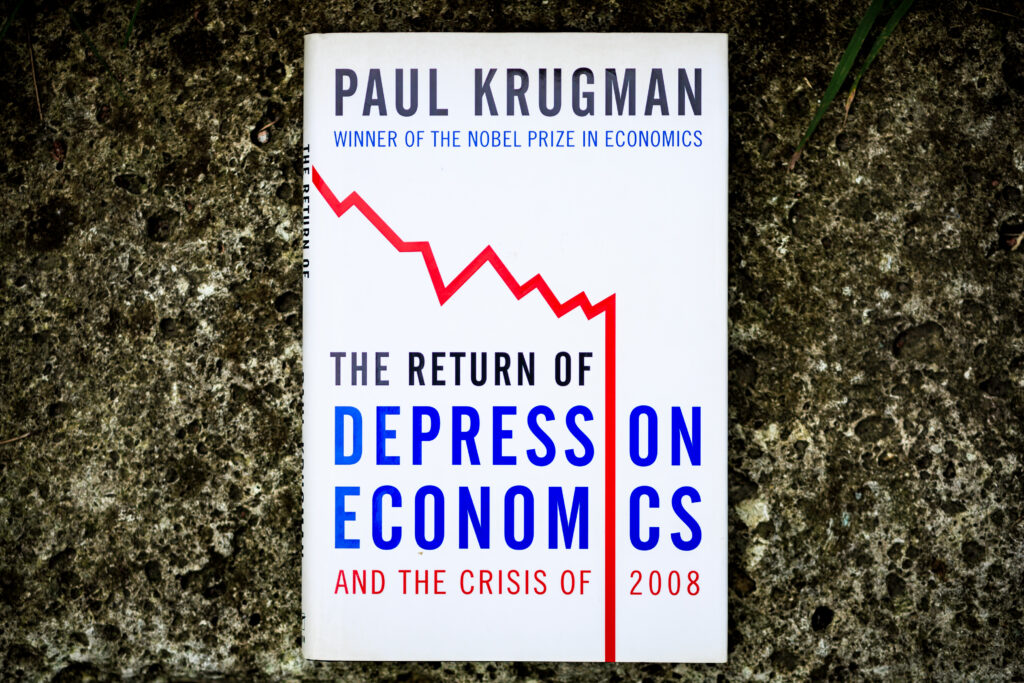

The book I recommend

“The Return of Depression Economics and the Crisis of 2008”

By Paul Krugman, Published by W.W. Norton & Company

Published during the 2008-2009 financial crisis, this edition criticizes U.S.-centric standard macroeconomic models and explains various financial crises mechanisms in the world in an intuitive way. The international perspective was new to me and broadened my horizons, sparking my interest in macroeconomics and financial crises. Learning about Japan’s zero interest rate policy was particularly inspiring, encouraging me to think outside the box and to conduct research using unconventional models.

-

Matthias Schlegl

- Associate Professor

Department of Economics

Faculty of Economics

- Associate Professor

-

Matthias Schlegl received his Ph.D. in Economics from Ludwig-Maximilians-University Munich, Germany. He also studied at the University of Oxford, University of California, Berkeley, and the Institute of Social and Economic Research (ISER) at Osaka University. His concurrent positions are visiting fellow at ISER and at the Faculty of Economics, Department of Economics at Sophia University where he has been an associate professor since 2019.

- Department of Economics

Interviewed: June 2024